Tax season – the time of year almost no one enjoys. For high net-worth individuals and highly compensation professionals like doctors and lawyers, it is the time of year to realize how much of their income goes to their silent partner: good old Uncle Sam.

It is common to feel concerned about how much you are losing by paying taxes, especially if you are in a high-paying specialty that puts you in the upper federal tax brackets. It gets even worse if you live in a state with high income taxes.

It is time to shift the way you think about money, especially if you are a W2 employee or a 1099 contractor where there is only so much you can do to control how much the government take from you before your hard-earned money hits your bank account.

“It is common to feel concerned about how much you are losing by paying taxes, especially if you are in a high-paying specialty that puts you in the upper federal tax brackets. It gets even worse if you live in a state with high income taxes.”

So what should you focus on?

Investing my capital in a way that is tax-efficient is crucial to keeping what you have earned. It is crucial that you take your hard-earned money and convert as much of it as possible into passive income, which is taxed much more favorably. The tax effeciency is why investing in real estate is one of the best ways to preserve and grow wealth and the best wealth-building strategy ever known to makind.

There are a number of deals you can invest your capital in as a limited partner. The General Partners (GPs), also known as Sponsors or Operators, manage these deals. They are called syndications or real estate funds. As limited partners, all you need to do is provide the capital, then sit back and let the professionals like us put your money to work. That is, purchase an asset (often multifamily properties/apartments), add value by renovating the units and improving on the amenities forcing the value to appreciate, and ultimately selling them for a profit.

The return these types of opportunities provide can be great, but they are even better through the many ways real estate can benefit from tax breaks and incentives.

Remember, the tax code is, in essence, a series of incentives written by the IRS to tell people how to spend and invest their money. And they have created huge incentives for investments in passive real estate.

Here are some of the top tax benefits of investing in a real estate syndication or fund.

1. Depreciation

This deduction is huge – and often overlooked. In tax terms, depreciation is when the IRS allows you to deduct the cost of business items with “shelf lives”, such as the building itself. It sounds simple, but some consider depreciation the most powerful tax benefit of investing in real estate. Over time, the real estate will start to “break down”. Fortunately, you can write off income-producing property based on wear and tear.

HOW DOES THIS WORK?

First, you have to determine the value of the actual building (apart from the land) and divide that value by the useful life of the property. According to the IRS, that lifespan is a number: 27.5 years for residential property and 39 years for a warehouse/commercial property. Then, each year, you deduct that precise amount.

For example, if the value of your rental property (the building itself) is at $500,000, you would divide that by 27.5 years (~$18,000). Now, you can deduct $18,000 as a depreciation expense each year for 27.5 years. This deduction allows you to report a smaller profit to the IRS, thereby reducing the amount you ultimately owe in taxes. In this way, you can offset the gains.

Usually, if you show a loss on paper due to depreciation, you can only use it to offset passive gains from other properties or investments. But, if your modified adjusted gross income is less than $100,000, you can offset $25,000 of your income. (That is typically not the case for the high nwt-worth individuals, though) Otherwise, if there is an excess loss, you must carry it forward to the following year.

However, there is a way to offset some of your active income. We talk about it in the section below.

BONUS DEPRECIATION

The Tax Cuts and the JOBS Act of 2017 changed some of the rules around depreciation. Businesses are now able to accelerate the timeline of the depreciation and take it earlier in the lifespan of the property.

This increases the amount an owner can depreciate and deduct early on. In fact, because of bonus depreciation, you can minus about 25% of the purchase price of the building in the first year (very roughly).

For example, if the building was $4 million dollars, investors can deduct $1 million in the first year alone. The depreciation has a huge impact on what shows up on your K-1.

We have invested in deals and received distributions, and on paper, our net income was, in fact, a loss due to the large amount of depreciation early on. So yes, we did not need to pay taxes on the distributions received. In fact, it offset gains from other real estate investments we made (a little more on that later)!

DEPRECIATION RECAPTURE

Now these deductions you have taken above will have to be accounted for when the property is sold. Uncle Sam needs his cut. However, the rate is still maxed at 25% – much better than the top income tax bracket. Not only that, but you have deferred paying taxes for some years.

2. Capital Gains

As you likely already know, capital gains are the profits from selling an asset. Of course, this is counted as income and will be taxed.

Interestingly, though, the tax rate is different than the rate for traditional income. For comparison, take a look at the following tables.

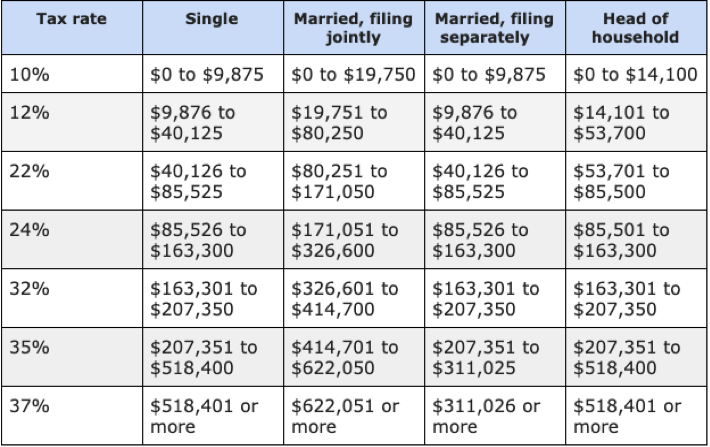

The first is the 2020 income tax bracket:

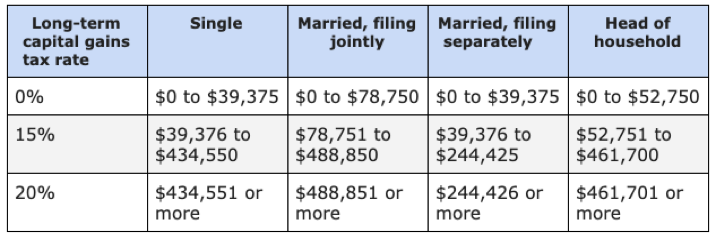

Compare this to the 2020 brackets for long-term capital gains:

An income from a real estate owned for more than a year is considered long-term capital gains. And as you can see, the tax rate caps at 20% – a far cry from the 35% or 37% you might have to pay on your day job income. Compound those gains overtime it becomes even more significant.

So to make it clear, the income you create from investing in real estate is far more tax efficient than what you make in your day job as a physician, a lawyer, or a director at a corporate firm. It is what we mean when we say that not all income is created equal.

3. Refinancing

Refinancing a real property is a great way to purchase additional assets if that is your goal. Essentially, with a refinance, you can borrow against the appreciation and increased equity of a property tax-free.

For example, if you bought an apartment building for $500,000. You renovate the property and command higher rents. The market value also improves. The property is now worth $1 million. You do a cash-out refinance and pull out $500,000 to put toward the purchase of the next building. This process is completely tax-free, and you can utilize this cash to continue growing your streams of passive income – without paying more in taxes.

4. Mortgage Interest Deduction

This one is pretty straightforward, but it is important to keep in mind when tax season rolls around. You may know that in the early part of a loan, majority of the payments goes toward the interest of the loan. These payments can be deducted.

Just as with a traditional home mortgage, interest payments from a rental property can also be deducted. This can certainly add up, especially in the first few years after purchasing a property.

5. Paper losses carried over to offset future gains or can offset current income

All of these deductions may actually end up showing as a net loss – on paper, at least. These deductions and losses can really only be used to offset other passive income gains.

This can be a great thing, because all the distributions you receive are essentially tax-free. If the losses exceed your gains, then you can carry those losses forward to offset other passive income.

However, there is a way to carry these losses beyond just other passive income and into the realm of “active” income, thereby greatly reducing your overall tax rate.

You see, in the eyes of the IRS, “passive” income (such as that from a rental property) and “active” income (such as your day job) are quite different. In short,you can use losses from passive income to offset other passive income. Likewise, to offset losses from active income, you would need to show active losses.

With a Real Estate Professional Status (REPS), however, all of your passive real estate income & losses can be considered active.

In other words, if you can obtain REPS, you can use any real estate losses to decrease the amount of income taxes you are liable for – even your W2 or 1099 income.

This can be hugely beneficial. There are a few requirements in order to obtain Real Estate Professional Status. We will discuss this in a different topic.

Summary

Adding up all these deductions and benefits can result in huge gains as an investor. Compound these gains over time, and it is clear how this can result in significant gains.

The above benefits, of course, are in addition to the monthly cash flow you will be getting from your passive real estate investing. With some knowledge and strategy, you can increase your profits – even when Uncle Sam comes knocking.

—

If you are interested in gaining a more in-depth knowledge to enable you confidently invest in our private, passive real estate deals, click here to send us a message.