What are Real Estate Syndications?

Real estate syndications are essentially group investments. Rather than investing in and managing a rental property on your own, real estate syndications allow you to invest passively, alongside dozens, and sometimes hundreds, of other investors just like you. Together, we invest in a commercial asset, like an apartment community.

When you invest passively in a real estate syndication, you get to invest your money and let us do the work for you. We find and manage the deals on your behalf. You sit back and enjoy the time and financial freedom, all while knowing that your hard-earned money is working on your behalf.

We acquire assets across the country with a primary focus on the Southeast, Mid-Atlantic, and Texas, where Westworth has current assets and infrastructure.

Our Approach

Westworth Capital focuses on passive income and wealth preservation for investors through private real estate investments. We acquire assets across the country with a primary focus on the Southeast, Mid-Atlantic, and Texas, where Westworth has current assets and infrastructure.

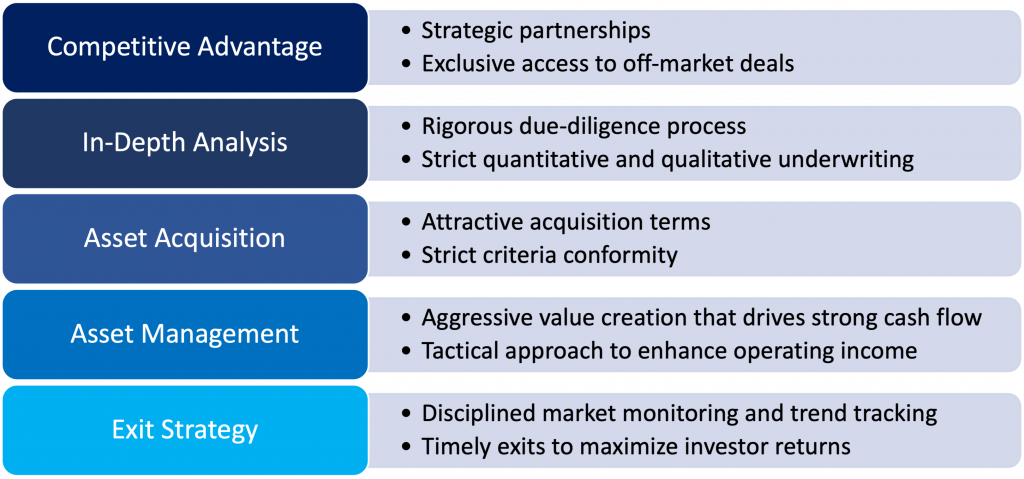

COMPETITIVE ADVANTAGE

We have members of our team living in many markets that we invest in. We have developed close relationships with the property managers, commercial property brokers, and agents in those markets. We are able to identify and acquire quality pocket listings – and focus on properties that are not on the radar of institutional investors but too large for the average individual investor.

INVESTOR ALIGNMENT

The team at Westworth Capital invests alongside our investors in every single property. This is a core value of our investment philosophy. We stand behind each investment we offer to investors by being the first to contribute our own money.

Additionally, our structure is set up so that Westworth Capital shares in the success of the investment, only if investors are profitable. We firmly believe that if we cannot deliver competitive profits to investors, we have not earned a share in those profits.

COMPREHENSIVE INVESTMENT MANAGEMENT

Westworth Capital identifies, analyzes, and selects portfolio investments based on strict quantitative and qualitative criteria. This disciplined due-diligence process ensures a data-driven approach to our investing.

Multifamily Value-Add

Our approach to multifamily investing is to add value.

Investors generally struggle to find the right balance between stable cash flow and appreciation potential. Westworth Capital’s unique approach to investing in multifamily properties achieves both objectives.

We are able to acquire properties at or below market prices due to our comprehensive data analysis. We buy quality properties in locations with growth potential and strong employment bases. Most of the time the properties have been poorly managed and have higher than market vacancy rates or require capital improvements.

Once re-positioned, the properties generate stable cash flows for investors year after year. And, the properties typically achieve a significant increase in value due to Westworth Capital’s management and property improvements. Once stabilized, we sell the property at market price for a healthy gain.

SO WHY MULTIFAMILY?

There are many advantages to owning multi-family real estate. Below are just a few:

Everyone needs a place to live

Multifamily is a highly recession resistant investment as people always need a place to live. Home ownership rates continue to fall as interest rates increase and housing preferences change to favor renting.

Stable cash flow generation

Multiple units provide protection to cash flow. With multiple tenants paying rent, there is not a reliance on a single tenant.

Ability to force appreciation

Multifamily investments are bought for their income production. By increasing the income produced, the value of the asset can be significantly increased, resulting in large gains.

Criteria

At Westworth Capital, we believe in the KISS methodology (keep It Simple Stupid), and that the most complicated investing criteria are not necessarily the most successful. That is why we have set a well-defined investing criteria which we follow and ingrain in the company culture.

Project Types: Multifamily & Commercial

We invest across the multi-family and commercial asset classes in resilient markets with a diverse set of employers throughout the U.S. Once acquired, these properties generate stable cash flows year after year and achieve healthy capital gains for our investors when we exit.

Asset Size: Up to 350 units, under $35MM

Because bigger isn’t always better. Studies show that the largest deals lag over the long-term, while medium-sized acquisitions boast stronger shareholder returns. Westworth Capital invests in assets that will benefit most from the integration of a strong management team implementing aggressive value creation tactics to enhance operating income.

Location & Demographics: Growth Factor

Westworth Capital evaluates U.S. markets based on local demand generators. We use a data-driven approach to analyzing economic strength, market stability, municipal objectives, population and job growth, and rental supply & demand trends.

Real estate investments across the Core, Core Plus, Value-Add, and Opportunistic asset classes

Below is a glimpse into the different types of asset classes and our investment sweet spot which are the A, B, and C asset classes. The value-add classes allow for adjusted risk and greater returns for our investors.

CORE

- Low risk/low return buy and hold strategy for predictable cash flows

- Stable, leased properties within strong rental markets

- Typically Class A buildings with high quality tenants and high rents

CORE PLUS

- Moderate risk/moderate return strategy

- Invest in Core properties that require some enhancement or value-add

- Typically Class B buildings with a strong tenant base

VALUE-ADD

- Medium risk/medium return strategy

- Acquire -> improve -> sell approach through physical or operational enhancements

- Typically Class B/C buildings with some need for renovation

OPPORTUNISTIC

- Typically class D. High risk/potential high return strategy

- Development opportunities or properties that require significant improvement

- Include vacant land developments, tear-downs, and construction projects

In a nutshell

What we invest in

Your Questions Answered

FAQ

Wish to invest with us?

Send us a message and let’s get to know you

No Offer of Securities – Disclosure of interests. Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1993, as amended or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.