For those who do not know these guys. we’ll do a quick dive into these two very successful entrepreneurs and their philosophy on money.

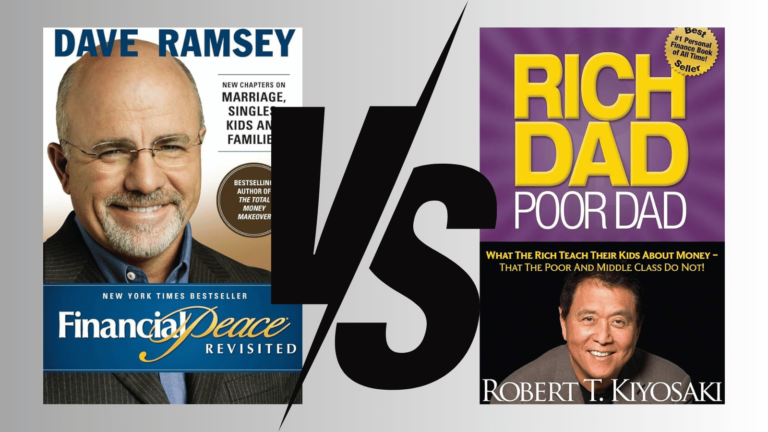

When it comes to personal finance and investing, few names are as prominent as Dave Ramsey and Robert Kiyosaki. Both have built substantial followings with their distinct philosophies, but their approaches are markedly different. Let’s discuss the contrasting views of these two financial gurus and see how their perspectives shape their advice on money management and investing.

Dave Ramsey: The Debt-Free Advocate

Dave Ramsey is best known for his strong stance against debt. His philosophy is rooted in the idea that financial freedom starts with getting out of debt and living within your means. Let me just summarize Ramsey’s approach with a few key principles:

1. The Baby Steps

Ramsey’s advice is structured around a series of “Baby Steps” that he outlines in his popular financial program. These steps include:

- Step 1: Save $1,000 for a starter emergency fund.

- Step 2: Pay off all debt (excluding the house) using the debt snowball method.

- Step 3: Save 3-6 months of expenses in an emergency fund.

- Step 4: Invest 15% of household income into retirement accounts.

- Step 5: Save for children’s college education.

- Step 6: Pay off your home early.

- Step 7: Build wealth and give generously.

2. The Debt Snowball Method

Ramsey advocates for the debt snowball method to pay off debt. This involves listing debts from smallest to largest and focusing on paying off the smallest debt first while making minimum payments on the others. As each debt is paid off, the freed-up money is applied to the next smallest debt, creating a “snowball” effect.

3. Budgeting and Financial Discipline

Ramsey emphasizes the importance of budgeting and living within your means. He believes that a zero-based budget, where every dollar is allocated to a specific purpose, is crucial for financial stability and growth.

4. Investment Strategy

When it comes to investing, Ramsey recommends a conservative approach. He advocates for investing in mutual funds with a long track record of success, and he advises against individual stocks and high-risk investments. His focus is on steady, long-term growth through diversified, low-cost mutual funds.

Robert Kiyosaki: The Wealth-Building Entrepreneur

Robert Kiyosaki, author of the best-selling book Rich Dad Poor Dad, offers a different perspective on money and investing. His approach centers around building wealth through entrepreneurship, investing in assets, and leveraging financial education. Here are the key elements of Kiyosaki’s philosophy:

1. The Rich Dad Philosophy

Like almost every real estate entrepreneur I know, this book marked the turning point in how they viewed money and financial freedom. Kiyosaki’s financial philosophy is based on the teachings of his “Rich Dad,” who emphasized the importance of financial education and investing in income-generating assets. His “Poor Dad” represents conventional wisdom and a focus on job security and traditional savings.

2. Investing in Assets

Unlike Ramsey’s conservative approach, Kiyosaki encourages investing in assets that generate passive income, such as real estate, stocks, and businesses. He believes in the power of leveraging investments to create wealth over time.

3. The Importance of Financial Education

Kiyosaki stresses the need for financial education and understanding how money works. He advocates for learning about investments, understanding market dynamics, and developing entrepreneurial skills as a means to achieve financial independence.

4. Risk and Leverage

Kiyosaki’s approach involves taking calculated risks and using leverage to maximize returns. He believes that embracing risk, rather than avoiding it, is essential for building significant wealth. This approach often involves investing in real estate, starting businesses, and using borrowed funds to increase potential returns.

Comparing the Two Approaches

Debt Management

- Dave Ramsey: Focuses on eliminating debt as a priority. His approach is conservative and emphasizes financial discipline.

- Robert Kiyosaki: Views debt differently, seeing it as a tool that, if managed wisely, can be used to acquire assets and build wealth.

Investing Strategies

- Dave Ramsey: Recommends low-risk investments like mutual funds and advocates for a steady, long-term approach.

- Robert Kiyosaki: Encourages investing in risk-adjusted assets such as real estate and businesses, believing in the potential for higher returns through leverage.

Financial Education

- Dave Ramsey: Emphasizes practical budgeting and financial discipline.

- Robert Kiyosaki: Stresses the importance of financial education and understanding investment opportunities.

Conclusion

Both Dave Ramsey and Robert Kiyosaki offer valuable insights into personal finance, but their approaches cater to different financial philosophies and goals. Ramsey’s method is ideal for those seeking financial stability and a debt-free life through disciplined budgeting and conservative investing. In contrast, Kiyosaki’s approach is suited for individuals looking to build wealth through entrepreneurship, investing, and leveraging financial opportunities.

Ultimately, the best approach depends on your financial goals, risk tolerance, and personal values. By understanding the core principles of both Ramsey and Kiyosaki, you can make informed decisions that align with your own financial aspirations and create a strategy that works best for you.

Are you an individual looking to build wealth through entrepreneurship, investing, and leveraging financial opportunities? If so, consider diving deeper into strategies that align with Kiyosaki’s philosophy. Download a copy of our comprehensive Multifamily Real Estate Investing Guide instantly for a detailed case study on how wealth is created using rental assets. This guide will provide you with practical insights and actionable steps to harness the power of real estate investing and start building your wealth today.