Not long ago, it was common for young adults to follow a simple route to owning a home. First, they’d rent an apartment, often with roommates. Then, they’d save up money until they could buy a starter home, usually after getting married. But now, because buying a home has become more expensive, more people are choosing to keep renting instead. And because of this, investing in buildings with multiple apartments has become more attractive.

Because buying a home has become more expensive, with both housing prices and mortgage rates going up, more people are finding renting to be a better option. Actually, the difference in cost between owning a home and renting an apartment is the biggest it’s been in 15 years.

A new study by Redfin found that across the country, on average, it costs about 25% more each month to own a home than to rent one. However, if mortgage rates go down, the difference between owning and renting would become smaller. For example, if mortgage rates dropped to 5%, buying the typical home would only be about 10% more expensive than renting it.

Factors Affecting the Home Prices

From January 2020 to August 2023, the typical price of a house in the U.S. went up by about 38% to $550,000, as per information from Redfin. Factors like higher mortgage rates have made it harder for people to afford homes. According to the National Association of Realtors, the average monthly mortgage payment (based on typical 30-year mortgage rates and home prices) went up by 85% in the last 20 months, from $1,212 in January 2002 to $2,243 in August 2023.

Over the past two years, mortgage rates have gone up a lot. For instance, on September 27, the average rate for a 30-year fixed mortgage was 7.55%, compared to 7.42% the week before. This increase in rates is due to a strong U.S. economy, the Federal Reserve Bank raising interest rates 11 times since March 2022, and a rise in 10-year Treasury yields, which affects mortgage rates.

How does this affect how much it costs to buy a home? Well, in 2023, the typical income for a family in the U.S. was $96,300. At the same time, the average price of a home sold was $407,100. If you put down a 20% down payment and get a mortgage at 7.55%, your monthly payment would be $2,288. That’s about 29% of a family’s monthly income. Last year, buying a typical home only took up 27% of a family’s monthly income.

Because of these higher costs, fewer people are applying for mortgages. In February 2023, mortgage applications were at their lowest in 28 years. By late September 2023, applications for buying homes had dropped by 27% compared to the previous year. Also, the number of existing homes being sold has gone down in 2023, including a 0.7% decrease in August. Compared to August 2022, there was a 15.3% drop in existing home sales.

What this means for real estate investors: The renting alternative.

Because owning a home has become expensive, more people are choosing to rent instead. This has caused rental prices to go up over the past three years. According to Chris Bruen from the National Multifamily Housing Council, the rent for apartments across the country has been increasing steadily since 2020, with an average yearly increase of 6.3%. This is much higher than the average increase of 3.4% seen in the five years before 2020. Additionally, inflation has gone up a lot since COVID-19 started.

A study by the National Multifamily Housing Council (NMHC) and the National Apartment Association found that there weren’t enough apartment buildings in 2021. They say this shortage, which has been going on since the 2008 financial crisis, means we’re not building enough apartments.

According to their research, to keep up with changes in the population and economy, the U.S. needs to build 4.3 million new apartments by 2035.

Here are some important things they found:

- The number of affordable units (with rents less than $1,000 per month) fell by 4.7 million from 2015 to 2020.

- Homeownership. Apartment demand also factors in a projected 3.8% increase in the homeownership rate.

- Immigration. Immigration is a significant component of apartment demand. Immigration fell before the pandemic and has not returned to pre pandemic levels. A trend reversal would boost apartment demand.

- Texas, Florida and California. These states account for 40% of future demand and will need 1.5 million new apartments by 2035, according to survey data.

Not building enough apartments is making rent prices go up because there aren’t enough places for everyone to live. This is just basic supply and demand. Other reasons why more people are looking for apartments include older people wanting to live alone, more single-parent families, and lots of millennials wanting to rent instead of buying homes.

In simple terms, CBRE found that more people are renting apartments, which is good news for the multifamily housing market. In the second quarter of 2023, there was a big increase in demand for rental units, the first significant increase since early 2021. The number of rented units went up by 70,200. CBRE also noticed that in the second quarter, the number of available apartments stayed about the same as the number of people looking for them, which helped keep things stable.

Investors are paying attention to these positive trends. Even though they didn’t invest as much in multifamily properties in the second quarter compared to last year, they still put in a good amount of money—$27.5 billion. That’s more than what was invested in the first quarter of 2023. Multifamily housing got the most investment out of all types of commercial real estate in the second quarter.

According to another CBRE study, a lot of global investors are interested in investing in multifamily properties, more so than in the past seven years. This type of investment was especially popular in the Americas, where 37% of people surveyed preferred it.

Overall, even though there are some challenges like more apartments sitting empty, investors still see multifamily properties as a good investment in the long run. That’s because there’s strong demand for rental units, especially from millennials and generation Z, who are choosing to rent rather than buy homes.

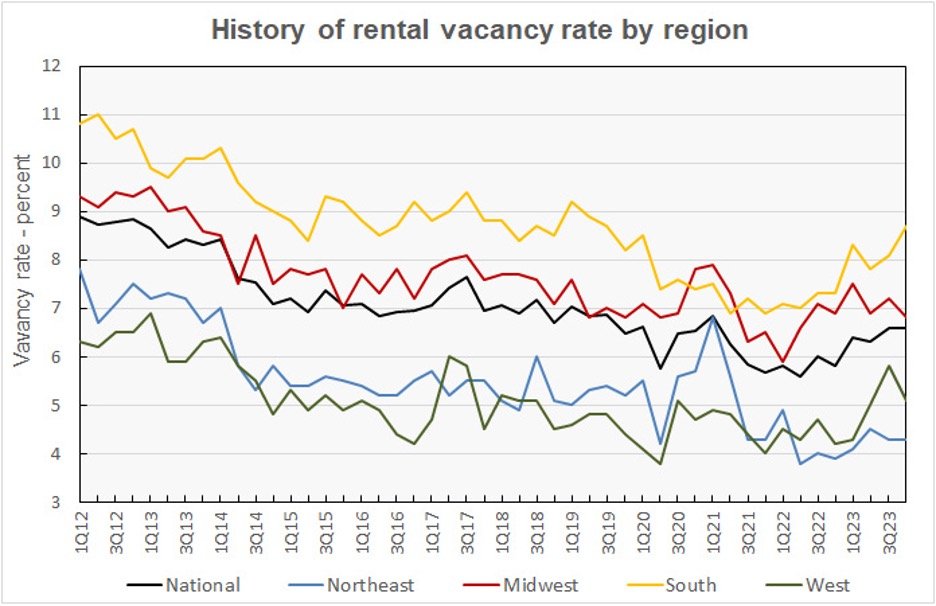

Multifamily properties offer investors an attractive risk/reward profile. It is well documented that multifamily properties perform better during a recession. In fact, The Census Bureau reported that the rental vacancy rate in the core cities of the Census Bureau’s Metropolitan Statistical Areas (MSAs) was 6.9 percent in Q4 2023, down from 7.3 reported for the previous quarter. The rental vacancy rate in the suburbs of the MSAs was 6.4 percent in Q3 2023, up 0.3 percentage points for the quarter. These trends are shown in the next chart, below.

Historically, the multifamily sector has been resilient during recessions. Current multifamily vacancy rates are lower than rates in previous economic slowdowns, and rental growth is robust. Even during the Global Financial Crisis (GFC) in 2008-2009, apartments’ (used as a proxy for multifamily properties) vacancy rates rose 0.75% versus an increase of about 2.75% in other property sub-asset classes.

Investors’ long-term outlook for multifamily properties is bullish. Favorable trends in the sector include robust demand from several generational cohorts, such as the large millennial and generation Z populations, who currently prefer to rent rather than purchase a home.

About Westworth Capital

Westworth Capital is a multifamily real estate syndication company focused on helping you maximize your investment potential and grow your wealth. We do the heavy lifting- which means you do not have to worry about the 3Ts (Tenants, Toilets, and Trash)- the real reason people stay away from rental real estate and fail to create real financial freedom and generational wealth. Westworth Capital Partners was formed with the objective of assisting you in passively investing in value-add multifamily assets to grow wealth for future generations while utilizing tax saving strategies and achieving early retirement goals. Our deals typically achieve an average annual return, of 20% with an investment duration of 3-5 years. Westworth Capital Partners team up with the nation’s largest award-winning property management companies, co-sponsors, and contractors while keeping asset management in-house to ensure continual clear communication of objectives and results to our investors.

Download our guide here to get started and be sure to join our no-fluff WhatsApp group of experienced and new investors below.